Neither in terms of their area – around 175,000 square kilometres – nor their total population – over six million – can the Baltic states be called real giants. However, they do score points as attractive hubs in east-west trade furnished with well-trained staff and a well-developed infrastructure. Above all, however, they are real pioneers when it comes to digitisation.

Photo: AdobeStock/Victor Grow

Additional photos: Hochschule Zwickau, AdobeStock/Rido, Assmann, Wettbewerbe-aktuell/Zaha Hadid Architects, RB Rail AS, AdobeStock/Wirestock, Vollers (2), PWL, privat, Žalgiris (2)

When we talk about the states of Estonia, Latvia and Lithuania, the term “Baltic States” has long since established itself as a synonym. But for Ralph M. Wrobel, professor of economics at the West Saxon University of Applied Sciences of Zwickau and an expert in economics, politics and history, this concept creates a false image in many people’s minds: “There is no such thing as a Baltic region with a homogeneous cultural or economic area. Rather, they are three small states on the eastern Baltic coast with their own characteristics and customs as well as different historical roots.”

The economic fields in which the three Baltic states can score points are correspondingly different. Estonia, the most northerly of the three states, is considered a trendsetter in digitisation. Textiles, furniture, food and machines are also produced there. Shipbuilding and agriculture also play an important role. The neighbouring state of Latvia not only forms the geographical centre of this trio, but, with its capital Riga, also has the most important trade and service centre in the region. The country has made a particular name for itself as an exporter of wood and agricultural products. Other cornerstones of the Latvian economy include the chemical industry, vehicle construction and logistics. Last but not least, Lithuania, as the southernmost of the Baltic states, is Germany’s most important trading partner in the region (see page 4) and is considered an important location for manufacturing companies in areas of mechanical engineering and metal processing, as well as in the furniture, chemical and textile industries. “Due to their relatively small and open economies, however, all three Baltic states are highly dependent on external economic factors and thus exposed to economic fluctuations of greater proportions,” Wrobel points out.

Interesting perspectives and “heavenly conditions”.

In his view, an important step towards the current international competitiveness of the three Baltic states was their entry into the European Union (EU) on 1 May 2004 and the associated introduction of the Euro. “That simplifies trade with these countries enormously. However, many German companies often overlook the opportunities available to them in this region because the three states have relatively small markets compared to their neighbour Russia. But it is precisely these that offer interesting prospects for German companies,”

“There is no such thing as a Baltic region with a homogeneous cultural or economic area.”

Prof. Dr. Dr. Ralph M. Wrobel, Professor of Economics at the West Saxon University of Applied Sciences of Zwickau

The corona pandemic has led to a surge in digitisation in many German companies, not just in the form of Zoom conferences. For the Baltic states, digitisation – from birth certificates to establishment of a company – has long been part and parcel of private and business life.

Wrobel states with certainty. Against this background, he no longer sees the three Baltic states as extended workbench to Western Europe, but rather as players with independent economic structures. Likewise, he considers the process of the often-cited “integration into Western structures” in all three states as already completed. “Now we have to defend these achievements against the sceptics,” states Wrobel.

Dr. Til Assmann, Honorary Consul of the Republic of Estonia in Bremen and Lower Saxony, sees great potential for the development of trade with Estonia, Latvia and Lithuania. “More and more German companies are relying on the flexibility, innovative strength and focused structures that exist in these states,” Assmann reports. This applies both to the general economic conditions there and the reliable northern European mentality of the people in their day-to-day dealings with one another. “For German entrepreneurs, conditions in the Baltic States are almost like being in paradise – either barely an hour and a half away by plane or in digital terms very close by. This is because what often used to be referred to as the ‘Baltic tigers’ have now become digital tiger states that make entrepreneurship incredibly easy compared to Germany,” states Assmann.

Assmann cites the lively start-up scene in Estonia as a prime example of digitisation in action, in the course of which five start-ups have already been named “unicorns”. This term is used to describe start-ups with a market valuation of more than one billion US dollars before going public. “This is a unique rate worldwide in relation to Estonia’s population of just 1.3 million,” Assmann points out – well aware that this is just one example of many for Estonia’s digital development. The entire public administration in the country was digitised and the right to Internet access was enshrined in law. “Digitisation in the Baltic states goes so far that about an hour after the birth of a child, the birth certificate, child benefit instructions and even suggestions for possible kindergartens are sent online. Moreover, a private tax return can be completed online in ten minutes and a whole company formed in 18 minutes,” states Assmann. In keeping with the pioneering role of the Baltic states in digitisation, Lithuania is said to have the best developed fibre-optic network in Europe, according to the German-Baltic Chamber of Commerce.

Infrastructure at European level

In terms of their infrastructure, the Baltic states were initially nowhere near as pioneering as they were in terms of digitisation. However, not least thanks to extensive funding from the EU, associated facilities and structures have been massively expanded in recent years. Hence Assmann attesting to the fact that all three nations have “an infrastructure at a high European level”. A central role is played by the ports, in which extensive investments have been made in recent years to ensure their long-term competitiveness. Klaipėda (Lithuania), Riga and Ventspils (both Latvia) and the Estonian capital of Tallinn are considered to be important maritime hubs in particular here. In 2019, for example, Klaipėda handled a total of 46.2 million tonnes, Riga 32.7 million tonnes, Ventspils 20.4 million tonnes and Tallinn 19.9 million tonnes. The most important maritime addressees on the German side are the ports in Bremerhaven and Hamburg. According to information from the German Federal Statistical Office, they handled more than half of the transhipments to the Baltic ports in 2019.

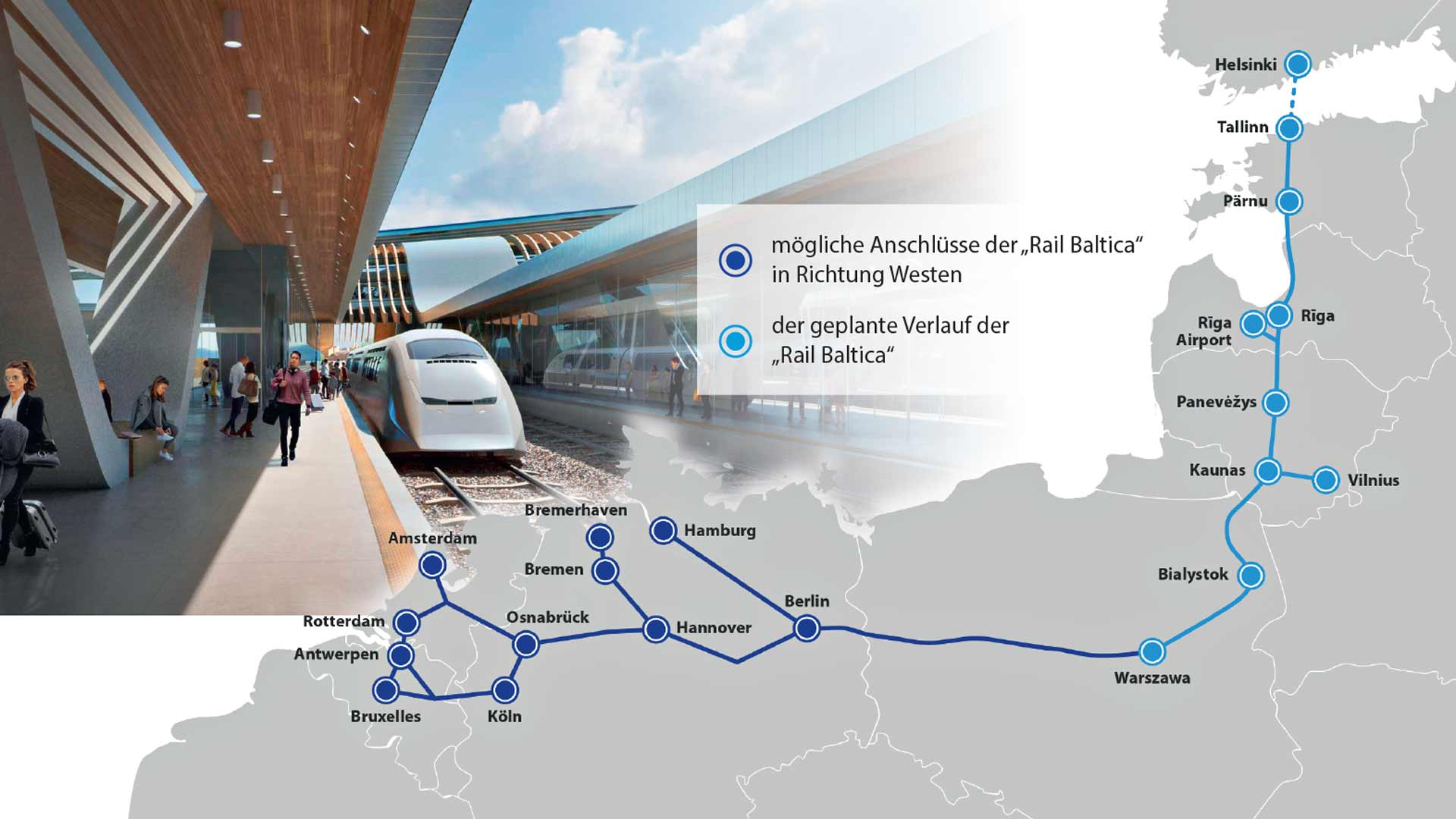

However, it is not only around the ports that investments are being made in infrastructure; numerous major projects can also be found on the agenda for other modes of transport in the coming years. These include, for example, the “Rail Baltica” rail construction project and the “Via Baltica” road construction project, both of which have already started. The EU member states Poland, Lithuania, Latvia, Estonia and Finland are involved in “Rail Baltica. This is a high-speedtrain line (249 km/h for passenger transport and 120 km/h for freight transport) planned over 870 kilometres, which is to run from Warsaw via Kaunas and Riga to Tallinn after its planned completion in 2026. From Tallinn it should then continue to Helsinki – possibly even through a tunnel. The special thing about it: The line, which is to connect the three states to the European railway network and ensure considerable time savings, is being developed in the standard gauge of 1,435 millimetres common in Western Europe and not – as is usual in the Baltic states – in the Russian wide gauge of 1,524 millimetres. “This will be a breakthrough for cross-border European rail traffic on the north-south axis – without the usual change of locomotives and wagons at the border,” hopes Assmann.

“For German entrepreneurs, conditions in the Baltic States are almost like paradise.”

Dr. Til Assmann, Honorary Consul of the Republic of Estonia in Bremen and Lower Saxony

Three Seas Initiative: Hope for a boost in development

In 2015, Poland’s President Andrzej Duda and Croatia’s President Kolinda Grabar-Kitarović launched what is known as the ‘Three Seas Initiative’. The ‘Three Seas Initiative’ is an association of the twelve Central and Eastern European EU states made up of Bulgaria, Estonia, Croatia, Latvia, Lithuania, Austria, Poland, Romania, Slovakia, Slovenia, the Czech Republic and Hungary. Its aim is to strengthen cooperation, especially in the areas of infrastructure, energy policy and security, in order to generate more attention for the political interests of the participating states within the EU. The initiative met for the first time in August 2016 in Dubrovnik, Croatia, and most recently in Tallinn in October 2020. The focus of the most recent conference was the expansion of the transport and energy infrastructure. According to the organisers, German President Frank-Walter Steinmeier and US Secretary of State Michael Pompeo were among the participants at the partly virtual summit due to coronavirus in the Estonian capital. Estonian President Kersti Kaljulaid pointed out during a video press conference that the Three Seas Initiative is the least developed, but at the same time, fastest growing part of the EU economically. She hopes that the initiative will give the region a new developmental boost. (bre)

“Rail Baltica” is a new rail link under construction, which will be completed by 2026 and run from Warsaw to Helsinki.

The 1,700-kilometre-long European route E 67, also known as “Via Baltica”, is considered to be the most important road connection in Northern Europe.

At the same time, the 1,700-kilometre-long European Route E 67 – the most important road transport link in north-eastern Europe – is to be successively expanded over the next few years. The route, also known as the “Via Baltica”, starts in Prague and then stretches from Wroclaw and Warsaw to Tallinn via Lazdijai, Kaunas and Riga. Finally, the ferry continues to Helsinki. The problem in relation: So far, the route has only been upgraded to two lanes in many places and, especially on Estonian terrain, does not yet meet the specifications of a motorway as we know it in Germany. When the trunk road will be expanded accordingly, however, is still unkown.

“The logistics clocks tick differently there”

Two companies that firmly believe in the Baltic as a logistics location are Vollers Group and PWL Group. For example, the Vollers Group, headquartered in Bremen, is represented in the Baltic market with two subsidiaries – in the port cities of Riga and Tallinn. The two locations play a key role for the logistics company, especially when it comes to storing coffee, cocoa and general cargo for the CIS region (Commonwealth of Independent States), i.e. for the states in the territory of the former Soviet Union. “Latvia and Estonia are optimal hubs between East and West for many merchants who want to bring coffee to Russia, for example. This is because there they are subject to EU law and the European financing system, but, at the same time, are close to Russia without having to pay the customs duties immediately due when entering the Russian market,” explains Christian Vollers, sole owner of Vollers Group since 2013. In Riga and Tallinn, the subsidiaries store the coffee and cocoa, sometimes for months, before it is transported further east: by wide-gauge railway to destinations more than 1,000 kilometres away, and by truck to destinations such as Moscow or St. Petersburg, which can be reached more quickly.

“The logistical clocks tick completely differently there and can in no way be compared with local logistical processes,” states Vollers. For example, the local quota for coffee in the Baltic states is around five percent, while in Germany it is around 95 percent. This means that while the share of goods in this country remains largely in the metropolitan region of the respective port, the relatively small markets in the Baltic states serve mainly as transit countries. A scenario that can also be transferred to other commodities, such as cotton and foodstuffs, and which brings with it special challenges. “Of course, it is not the ‘Wild East’, but you should make sure you have reliable staff and partners in the region who can speak Russian, so that you can easily contact the appropriate intermediaries in case of possible disruptions,” states Vollers. This is why, for him, good documentation of the transport chains and professional expertise are the most important factors of survival in the markets east of the Baltic.

Logistics Pilot

The current print edition - request it now free of charge.

“For many traders, Latvia and Estonia are ideal hubs between the East and West.”

Christian Vollers, owner of the Vollers Group

Well-stocked coffee warehouse from the Vollers Group for onward transport to the Baltic States and Russia. The Bremen-based company also transports cocoa and general cargo to the east.

A handshake still counts in the Baltic States

The PWL Group has also been active in the Baltic States since 2014. The Bremen-based shipping and transport sector service provider has primarily specialised in exporting commercial goods and food shipments from Europe, but also covers project shipments to the region. “The market there is very dynamic and requires a short response time and a high degree of flexibility. We often we receive an enquiry one week and the shipment needs to reach its destination by the week after,” reports Sebastian Dörr, Director PWL Worldwide Logistics. Most recently, for example, used clothing was brought to Estonia and Latvia, where it was processed and sold in second-hand shops. On the other hand, specially coated cardboard packaging for foodstuffs and adhesive films for industry have also been seen on the company’s to-do list recently. “We make sure that the cargo arrives safely at its port of destination, regardless of whether it is Klaipėda, Tallinn or Riga. However, since Russia also belongs to our Baltic network, the port in St. Petersburg is also served, too,” states Dörr. The PWL Group then commissions a reliable freight forwarder for the onward carriage. “Experience has shown that it is best when you know your partners here personally. Moreover, when trading with the Baltic states, a handshake still counts,” states Dörr, identifying two more customs in the market there.

“The future starts now”

In contrast to the Vollers Group and the PWL Group, and despite the good conditions in the Baltic States, relatively few players have ventured into the region so far. Assmann makes a critical remark accordingly: “Since 1991 and in principle until today, companies from Bremen and Lower Saxony have paid respect to the diverse opportunities available in the Baltic States, but have mostly limited their involvement to consulting, cooperation and trade relations, hence hardly taking advantage of the real opportunities”. As examples of companies that have implemented large-scale measures there, he cites Kühne + Nagel (IT centre in Estonia), Continental Automotive (industrial production in Lithuania), Knauf and Schwenk (building materials in Latvia) and Hamburger Hafen und Logistik AG (HHLA, container terminal in Estonia). His emotional appeal to local companies is therefore: “All port locations with their logistics service providers in Estonia, Latvia and Lithuania offer optimal opportunities. Do not wait another 30 years – the future starts now!” (bre)

“The market is very dynamic and requires a short response time and a high degree of flexibility.”

Sebastian Dörr, Director PWL Worldwide Logistics

Here PWL handled a shipment of rotor blades to Africa via the Latvian port of Liepāja.

“I haven’t experienced an anti-corona demonstration in Lithuania yet”.

Born in Bremerhaven, Arne Woltmann started his basketball career at the age of twelve with 1. BC Bremerhaven and later even made the leap into the Bundesliga. After the end of his active career, the 2.02-metre-tall centre player was drawn to the coaching bench – among other things for the German national team and the Eisbären Bremerhaven. Woltmann has been assistant coach at Žalgiris Kaunas in Lithuania since August.

Most read